Making better market timing decisions using DCF valuation

Market tops and bottoms are for fools and liars

"Market tops and bottoms are for fools and liars" is a popular adage on wall street that advocates the futility of timing the turns of the stock market. While some traders may have gotten the occasional bet right, most serious investors haven’t had much success trying to catch turns. On the contrary, several investors have lost huge sums of capital trying to catch falling knives in a market crash or trying to go short in secular up trending markets. Its not just retail investors that fall for this trap, sometimes even sophisticated professional investors tend to get lured by Mr. Market.

Even "smart money" gets it wrong sometimes

Billionaire investor Bill Ackman liquidated a $1.1 billion long position on Netflix in April 2022, taking a loss of more than $400 million as the streaming service's stock plunged following news that it had lost subscribers for the first time in almost a decade. Ackman's hedge fund Pershing Square Capital had invested over $1 billion in early 2022 following a sharp decline in Netflix shares. “The opportunity to acquire Netflix at an attractive valuation emerged when investors reacted negatively to the recent quarter’s subscriber growth and management’s short-term guidance,” Ackman explained in a letter to his investors. Netflix's stock was trading at ~$390 in late January 2022, around the time of Ackman's purchase. He exited his position at roughly $225 a share, which in hindsight may look like a good decision as Netflix was trading near its 52-week low share price of $175 in July 2022.

Finding margin of safety

Going against the trend typically hurts investors and traders alike. So, is it even possible to time the markets with a reasonable "margin of safety"? The answer is yes, BUT typically at points of extreme optimism and pessimism. Pandemic crash lows of March-April 2020 and global financial crisis meltdown of March 2009 are some examples of extreme pessimism in financial markets globally. The dot-com bubble of 1999-2000 and 2020-2021 rally in tech stocks in the US saw extremes on the upside with stratospheric valuation of companies which didn’t even make a single dollar in revenues, let alone free cash flow. So how does one stay grounded and make money in such tumultuous market conditions?

Buffett was right!

Clearing the noise and going back to the fundamentals always helps- in life and in markets! The discounted cash flow (DCF) valuation methodology provides an objective view of the long-term drivers of a stock's intrinsic value. Intrinsic value of a company is measured as the sum of the present value of the future cash flows a company is expected to generate. Market value of the stock of a company (as well as the total market) may deviate wildly from its intrinsic value on both the upside and downside. Smart investors typically profit from these extremes when markets provide them attractive entry and exit points. This is where the DCF valuation comes in handy to understand the extent of this deviation from intrinsic value. This works beautifully in times of panic as well as exuberance.

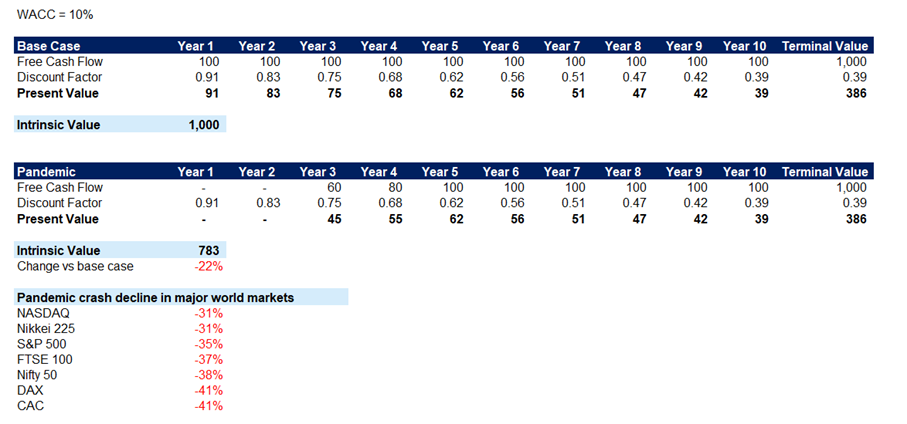

Let's look at the recent pandemic induced stock market sell-off of March-April 2020. Major stock markets across the globe declined anywhere between 30-40% from their Jan 2020 peaks. Did that really imply a 30-40% decline in the intrinsic value? Or was it fear of permanent loss of capital that forced investors to liquidate and move to safer assets?

Making money in stocks using DCF valuation

We constructed a simplified view of the stock market (Exhibit 1)- where we compare how the pandemic-led disruptions would impact future cash flows of the market in aggregate. We found that even if the pandemic resulted in no cashflows for 2 full years and if it took 5 years for full recovery, it would lead to a decline of about 22% in intrinsic value vs base case. Even with such pessimistic assumptions, the decline is far from how markets reacted during that phase. Some basic financial modeling would have given long-term investors the confidence to "buy the fear". Using this template provides investors a simple yet powerful tool to finding lucrative entry and exit points in the stock market.

Exhibit 1

Figuring out when to exit (this is a tough one!)

Market tops are probably more difficult to time given euphoria and the broadly positive sentiment. Again, a clinically crafted DCF valuation can give investors a clear indication of froth in the stock market (or at least parts of the market). We admit, this will be bit of an art as gauging sentiment is not easy!

Here are some points to consider-

1. Are the growth rates implied in current valuation sustainable?

2. Can companies protect current high levels of profitability?

3. How does the weight of a company/sector in the index compare against historical averages?

4. Are the DCF implied multiples well above historical averages and other industries?

5. Have fund raising and IPOs spiked in recent years?

Making sense of markets

Your DCF valuation is only as good as its inputs, so be meticulous with your assumptions and pressure-test results. Using a range of scenarios is probably the best way to go and that’s how sophisticated investors make investment decisions.

For retail investors- the DCF valuation methodology is not as complicated as investment professionals and analysts make it out to be. Any investor with some basic knowledge of finance can use it to make smarter investment decisions. It may not help you find the next best trade but will certainly help you understand the internals of the markets in times of extreme greed and fear.

Happy investing!

Member discussion